INTRO

Jeffrey Huang, known online as Machi Big Brother, is a former Taiwanese-American musician and tech entrepreneur. What follows is an extensive overview of Jeff’s history in the crypto space, a brief synopsis of Formosa, his subsequent projects, the other players involved, and as always, the data to back it up.

Over the past year, ‘Machi Big Brother’ aka Jeff Huang has become well-known in the NFT space as one of the largest Bored Ape Yacht Club holders. Despite this, few know of his history in the crypto space.

BACKGROUND

Jeff Huang first received notoriety as a founding member of pop/rap trio L.A. Boyz, formed in 1991. Active in the early to late 90s, L.A. Boyz released 13 albums and rose to popularity in Asia before eventually disbanding in 1997.

After finding success with L.A. Boyz, Huang found repeated success with the formation of hip hop group Machi in 2003. MACHI Entertainment, a prolific Asian hip hop/rap record label and subsidiary of Warner Music Taiwan founded by Huang and cohorts was to follow. Eventually, Huang transitioned from the music business to the tech sector with the creation of 17 Media (M17). Founded in 2015, M17 grew to become one of the most popular live-streaming apps in Asia before later on successfully exiting.

In 2017, Huang began his foray into the crypto space with Mithril, the first in a string of projects with vivid team members and wild price fluctuations. Let’s dive in.

Project 1: Mithril

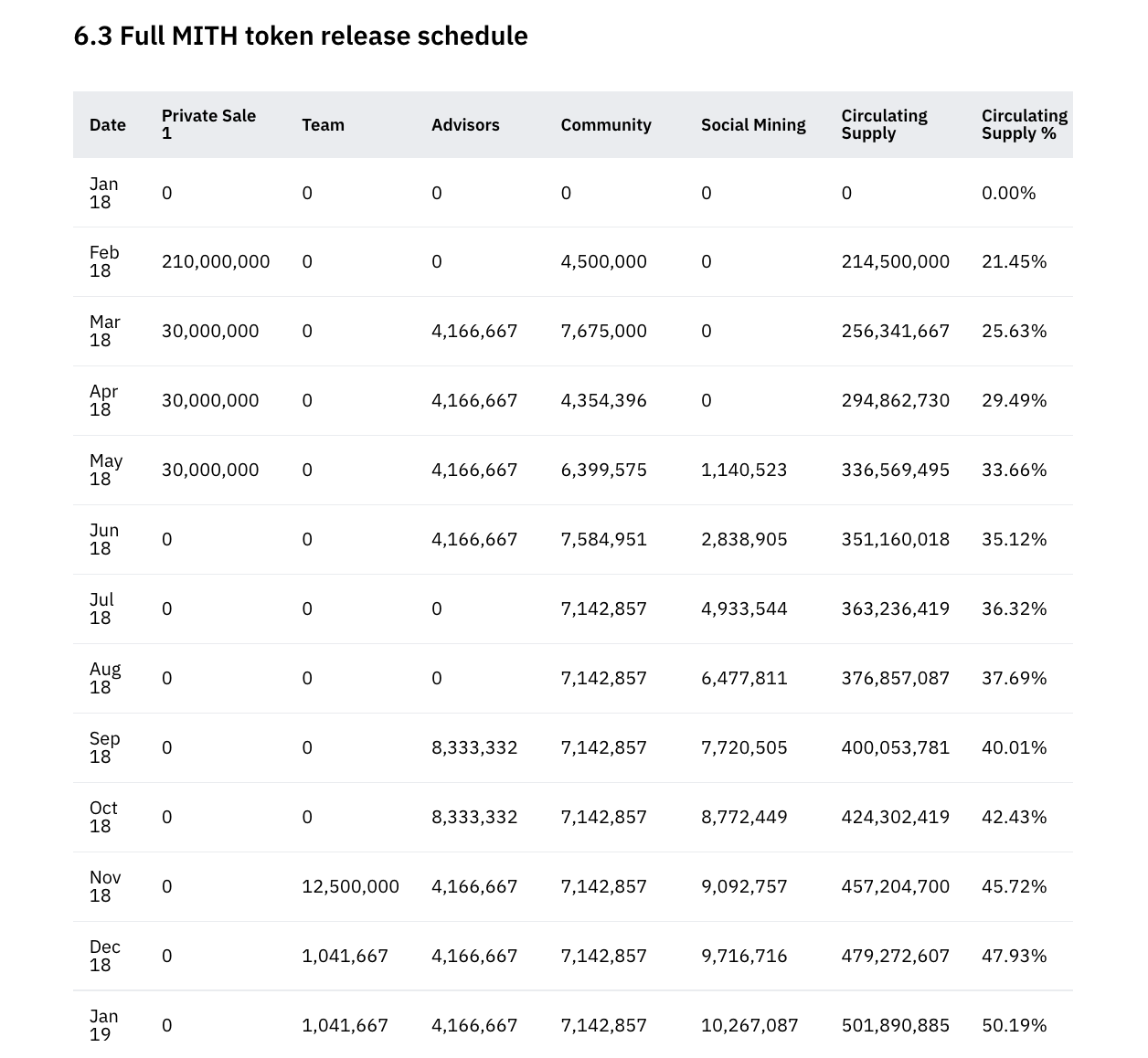

In late 2017, Huang founded Mithril, a decentralized social media platform aimed at directly rewarding content creators with its native token MITH. Mithril conducted a private token sale on February 21, 2018, 70% of the tokens sold unlocked at TGE in February 2018, with the remaining 30% unlocking over the next three months. In April of 2018 Mithril listed on the centralized exchange Bithumb. By May of 2018, MITH tokens were fully vested, and by then, represented 89% of the circulating supply, resulting in huge selling pressure.

Jeff Huang: “Mithril was supported by large asian whales such as Wang Sicong and was one of the most successful launches of 2017”

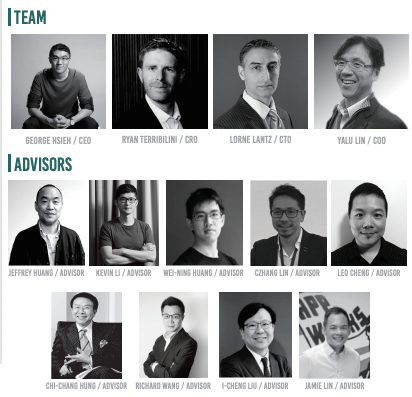

Project 2: Formosa

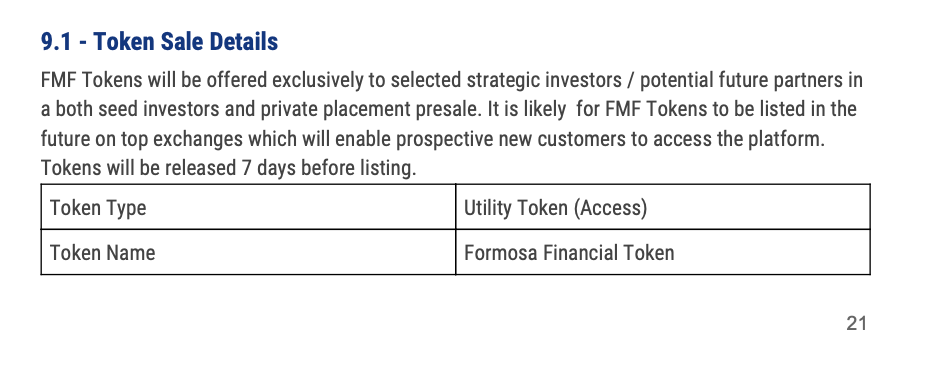

Beginning in early 2018, Huang worked as an advisor with George Hsieh, a Taiwanese politician, Czhang Lin, and Ryan Terribilini to build Formosa Financial, a treasury management platform built for blockchain companies. Formosa Financial held an angel round which closed the last week of April 2018, raising 22,000 ETH. A private sale round closed on May 31st which raised an additional 22,000 ETH. This accounted for 30% of the total token supply. In total, Formosa raised $23m USD (44,000 ETH). Notable investors included Binance, QCP Capital, Lemnis Cap, Block One, Mithril/Jeff Huang, Maicoin, Wilson Huang, Leo Cheng’s Syndicate, Blockstate, and Block One.

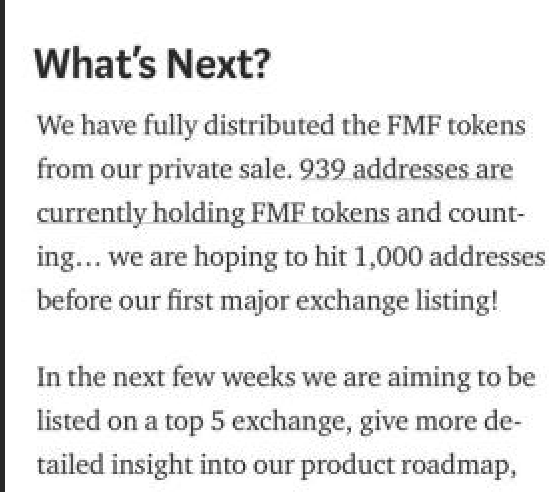

Investors were sold on the premise that FMF was on a fast track to receiving a top-tier CEX listing.

Excerpt from deleted Medium article

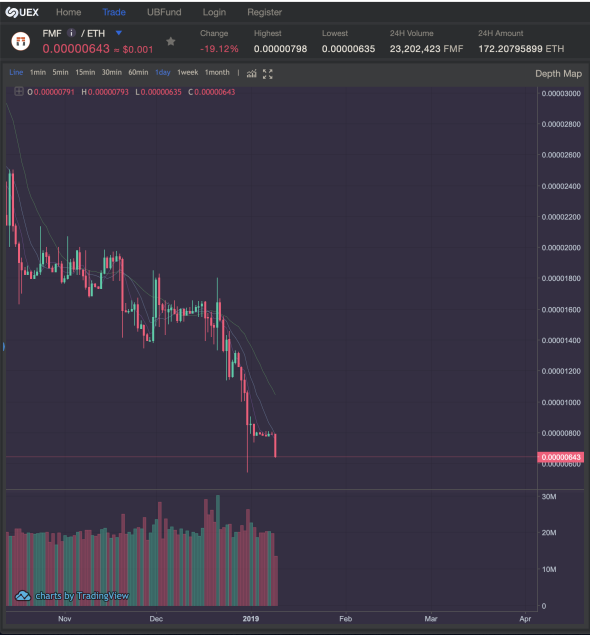

Trading for FMF went live in June 2018 on IDEX where it immediately plummeted. It wouldn’t list on centralized exchanges (IDCM, UEX) until September 2018.

Additionally, 17 Media was scheduled to IPO on the NYSE on June 7th 2018, but due to unspecified settlement issues with investors, the IPO launch was postponed after plans to raise 115m USD fell through. After Jeff took to Facebook to express his frustration, directing expletives at Citibank and Deutsche Bank, both of whom were involved with the IPO.

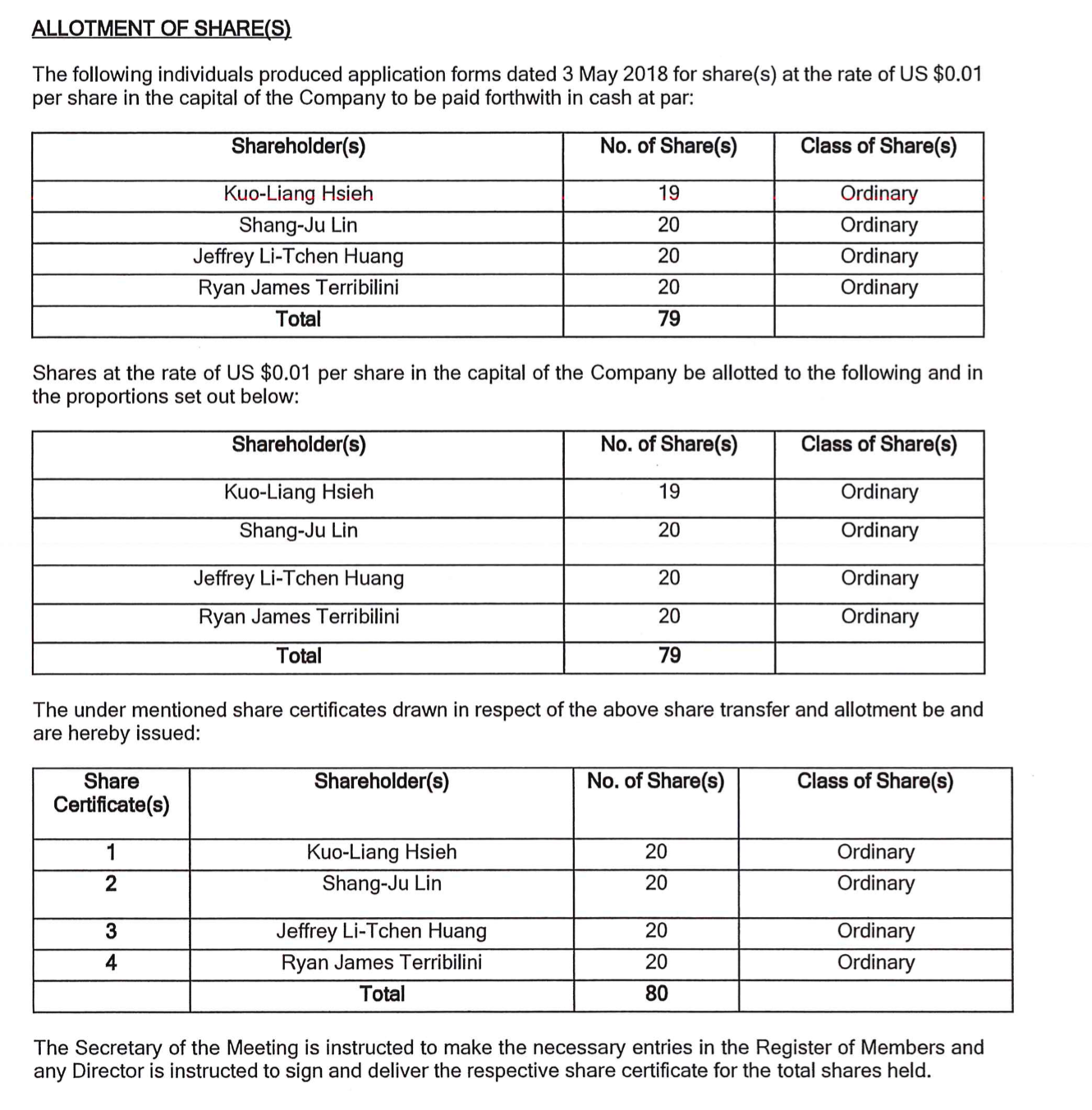

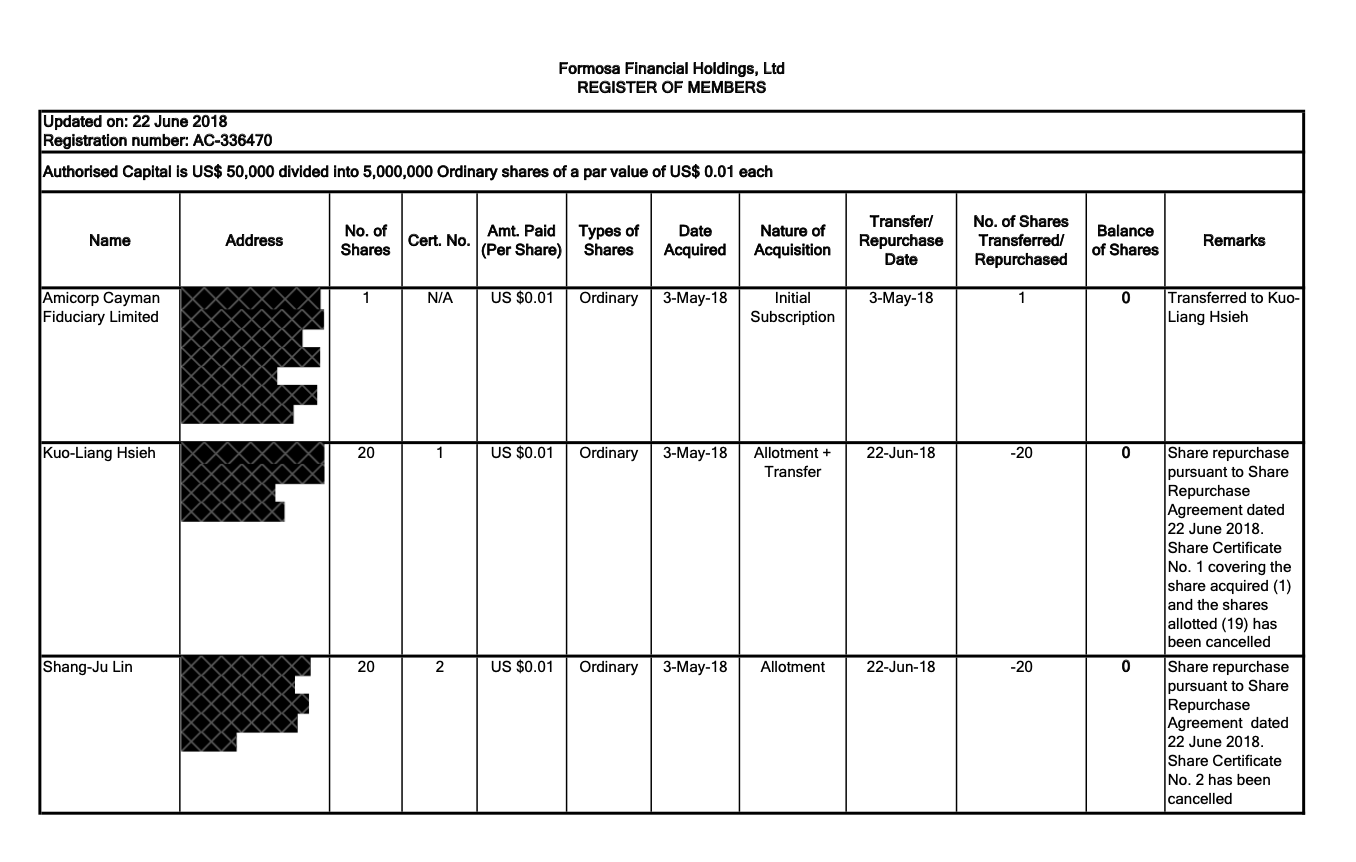

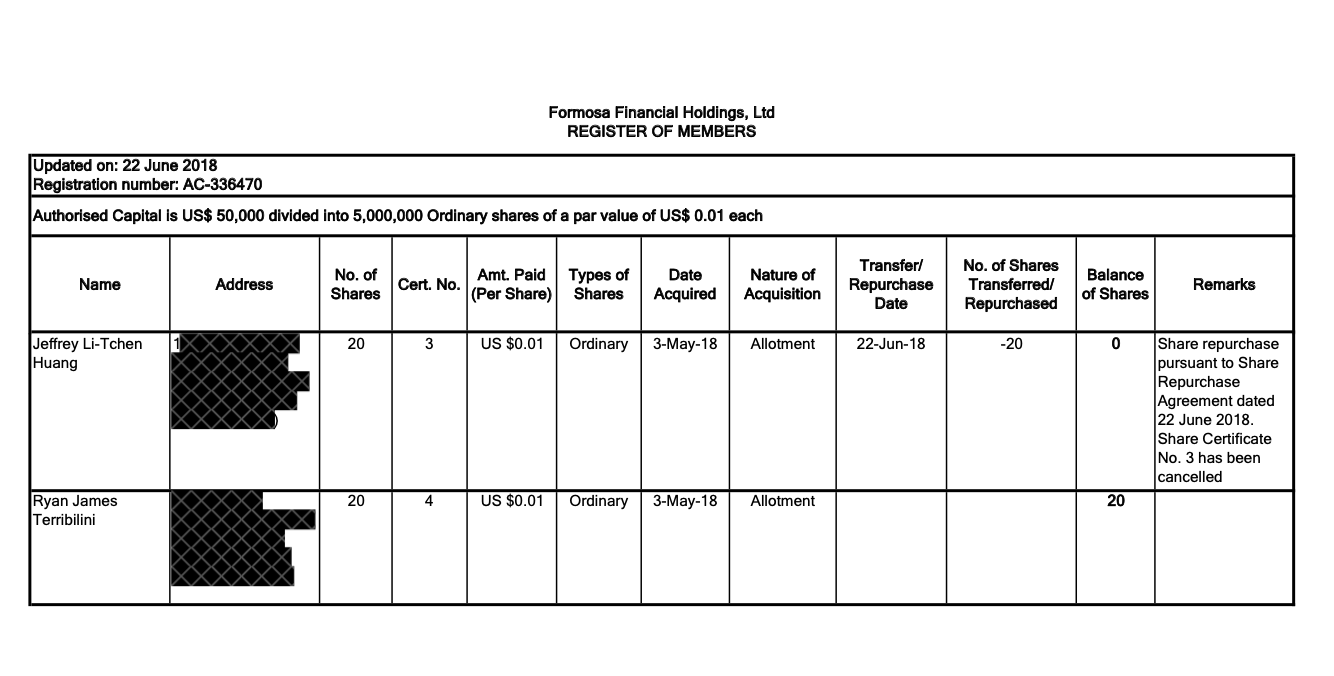

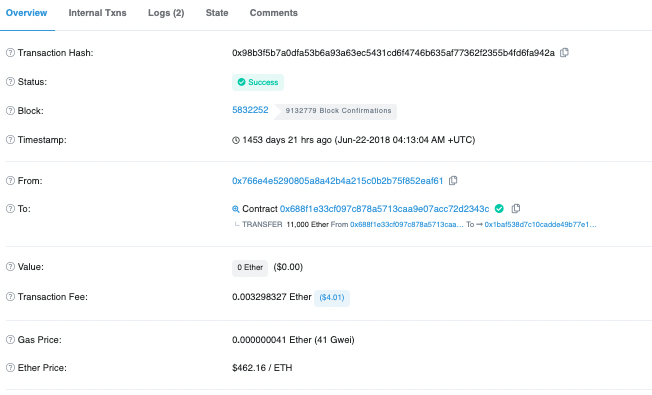

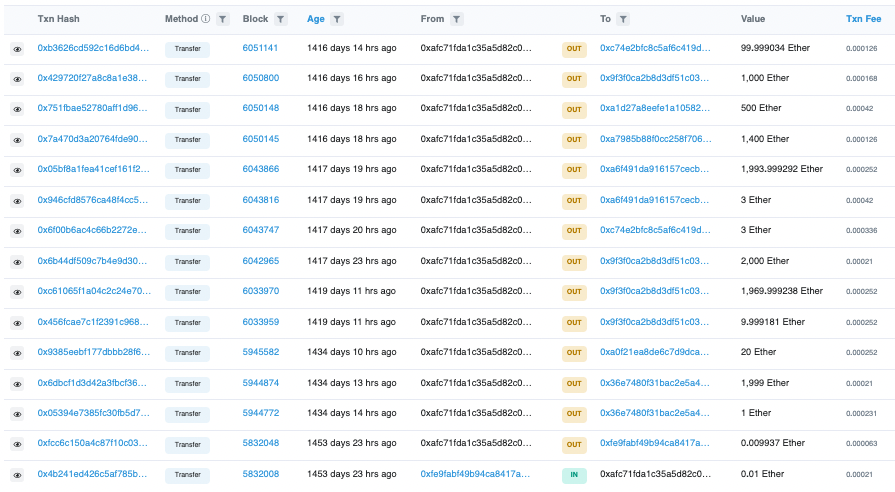

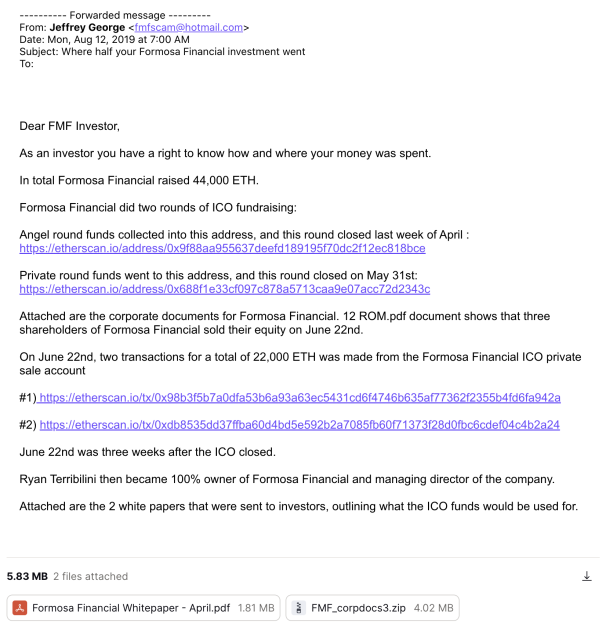

Three weeks after the FMF ICO, Formosa Financial took a turn for the worse when two withdrawals of 11,000 ETH each were made from the Formosa Financial treasury wallet on June 22nd 2018 through the help of Ryan Terribilini. Unbeknownst to investors, cofounder George Hsieh had acted as sole director of the company, pushing a share buyback through himself, executing on both sides.

Share buyback made on June 22nd 2018

Share buyback made on June 22nd 2018

George Hsieh and Yalu Lin relinquished their formal roles leaving remaining co-founder Ryan Terribilini as CEO and Lorne Lantz as CTO.

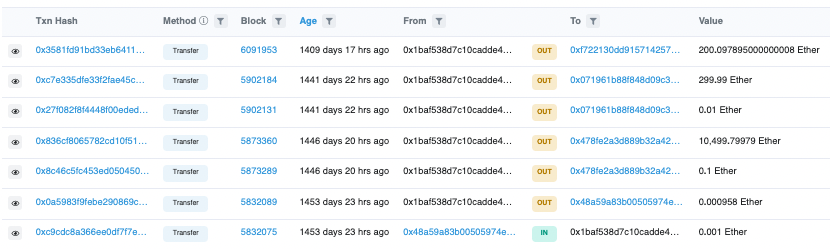

This chart displays the ETH inflows of angel/private round funds into the multisig before the two 11,000 ETH withdrawals were made on June 22, 2018.

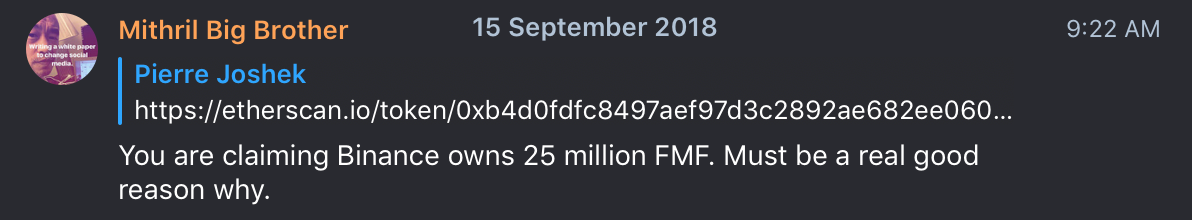

On June 29th 2018, a transfer was made of 10,500 ETH to a Binance account. The veracity of the Binance account’s KYC is unknown at this time.

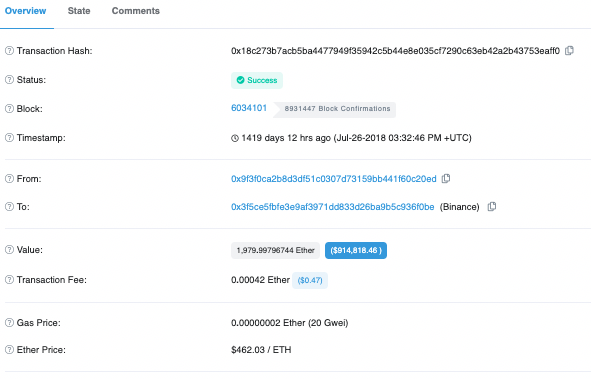

The other 11,000 ETH sat untouched in a wallet until transfers of 4980 ETH, 1997 ETH, 1,400 ETH, 500 ETH, 103 ETH were made to various Binance accounts in late June & early July. 2,000 ETH was sent to czhang.eth, and 20 ETH was allocated to an EOA wallet.

The question remains: Who do the Binance accounts and the wallets belong to? Let’s dig deeper and take a closer look at some of these ETH outflows!

- 4980 ETH outflow made on 7/26–7/29 2018: Records show that this Binance account has frequent inflows from two sources: FTX and littlebang.eth

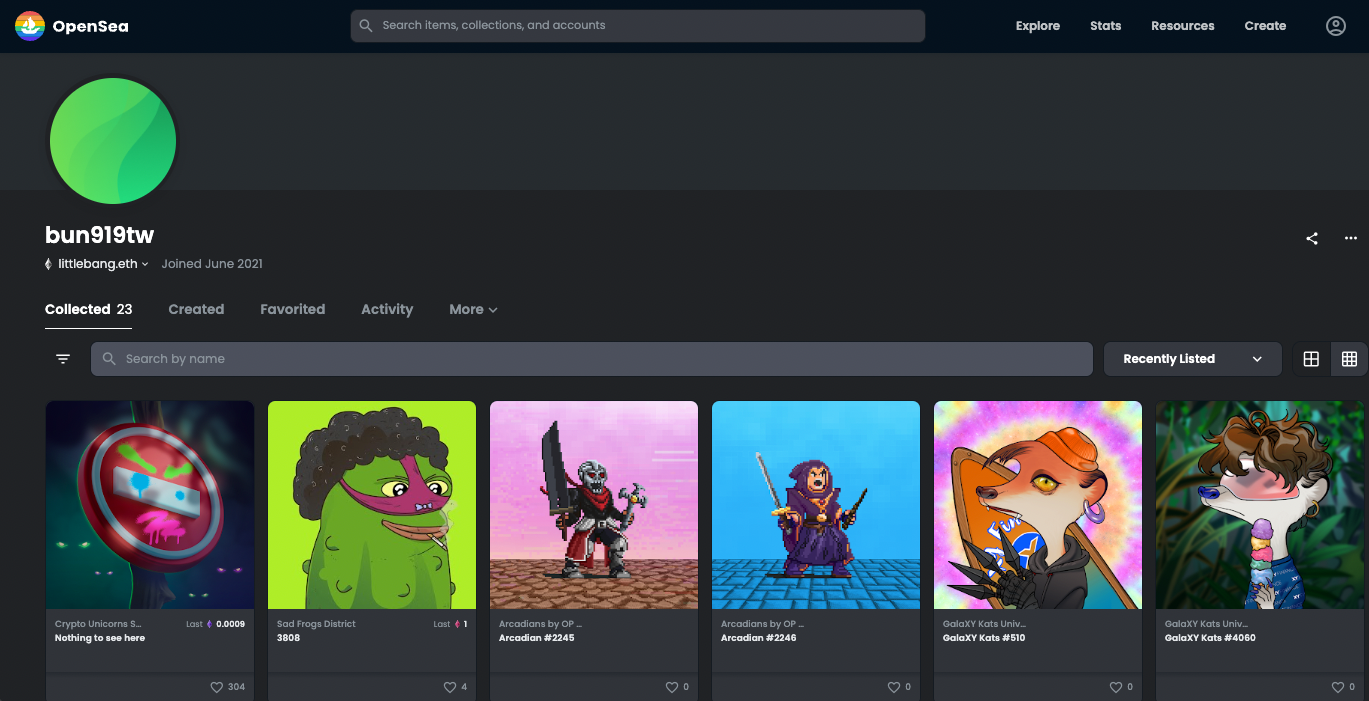

1a). If we look up the owner of littlebang.eth on OpenSea we see they have the username “Bun919tw”

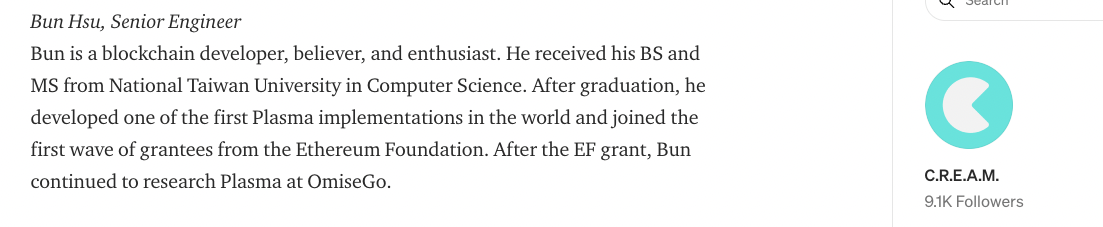

b). A quick Google search reveals “bun919tw” is actually Bun Hsu, a Cream Finance core engineer (Cream is another Jeff Huang project.)

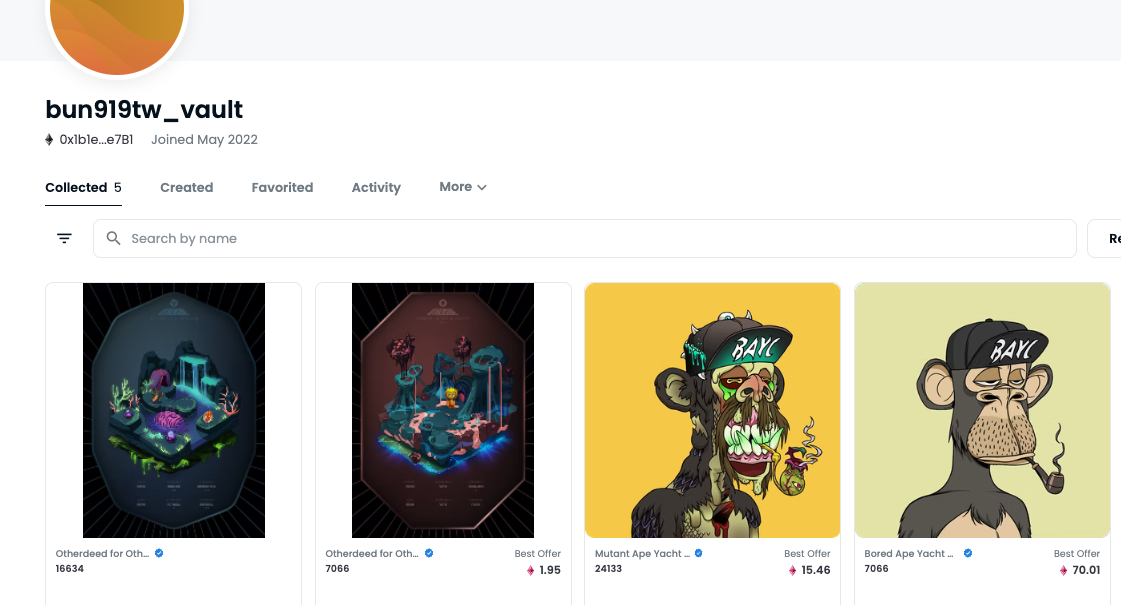

c). Bun Hsu’s Twitter profile picture is BAYC #7066, which was gifted to him by machibigbrother.eth (Jeff’s public wallet) for his contribution to another project.

d). Bun Hsu happens to have traded multiple Jeff projects such as FMF, SWAG, CREAM, SQUID, MCX.

Why did an individual who was not on the Formosa Financial team receive 4980 ETH just 3 weeks after the ICO, trade tokens from other Jeff projects, and a BAYC from Jeff himself?

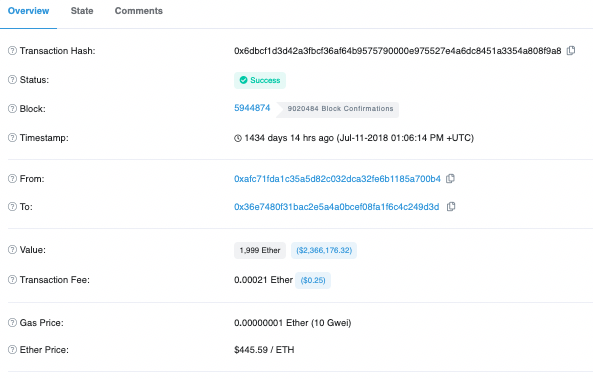

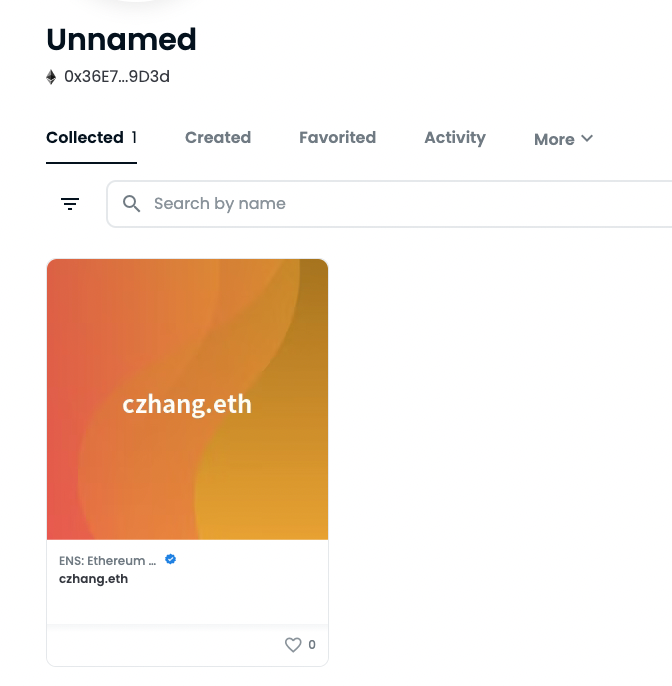

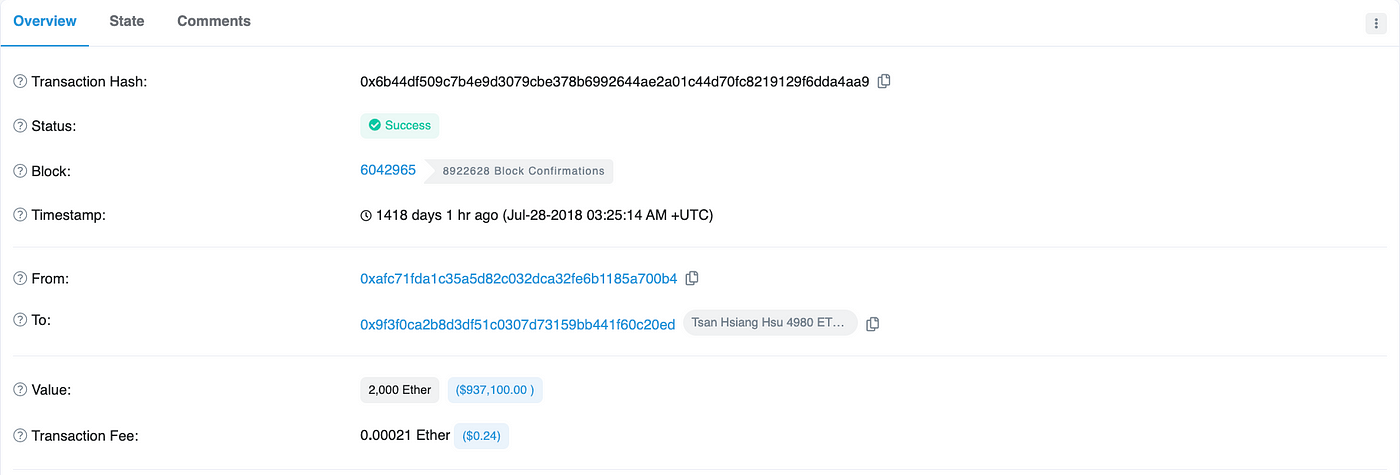

2. 2000 ETH outflow made on July 11th 2018: The blockchain shows that this transaction was received by czhang.eth (Czhang Lin). Lin held the role of advisor at Formosa Financial until June 22nd.

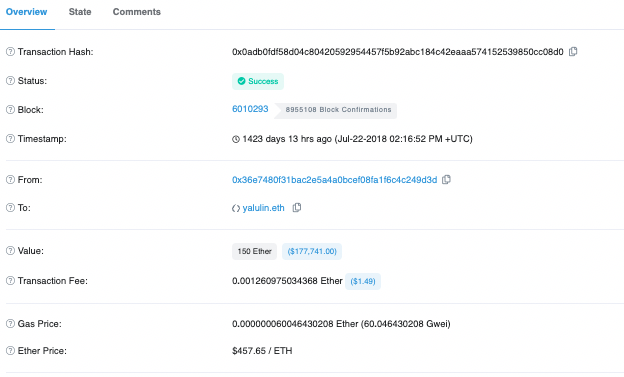

a). Three weeks after Czhang received the 2000 ETH, Czhang sent 150 ETH to his brother Yalu Lin (Formosa COO) on July 22nd 2018.

Once again why is an advisor & COO of Formosa Financial receiving money intended to build the project?

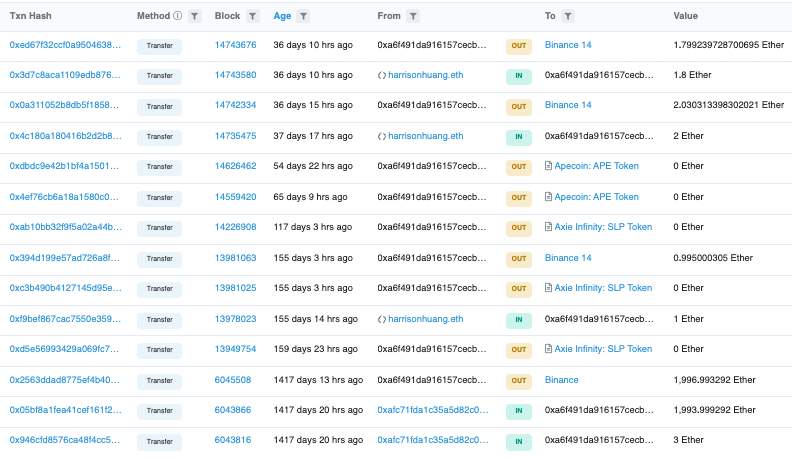

3. 1997 ETH outflow made on July 28th 2018: The only inflows to this Binance account are from harrisonhuang.eth, an account that has frequent interaction with w9g.eth (Wilson Huang), VP of engineering at Mithril, and the current founder of XY Finance and GalaXY Kats.

Wilson gifting NFT to Harrison

Harrison gifting MAYC to Wilson

a). A quick Twitter search of harrisonhuang.eth reveals what we can presume to be his Twitter account, since he tweeted out his ENS address as a reply to Wilson.

Link to Tweet

Harrison is not listed as a team member on the Formosa Financial whitepaper or website. Once again a pattern emerges of individuals not publicly associated with Formosa receiving project funds.

While Wilson and Harrison do share the same last name as Jeff they are not family members.

The remainder of the Binance accounts that received funds from Huang lead to dead ends; the accounts do not have any recent interactions with other external or personal addresses and transactions are only movements from CEX to CEX.

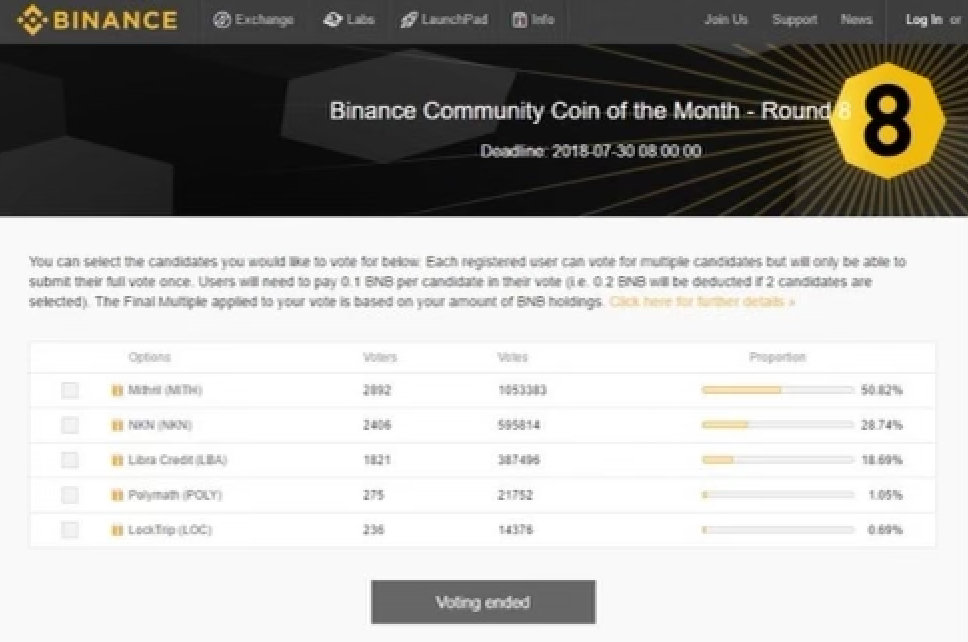

On July 26th 2018, Jeff and Mithril were accused of trying to cheat the Binance monthly Community Coin vote. A user named Lucky uncovered evidence showing that Mithril received over 80,000 votes which were funded solely by two to three addresses. The Community Coin vote functions thusly: 1 BNB is equal to 1 vote, with up to 500 BNB/votes allowable per account, so that one voter is able to receive a maximum of 500 votes by holding 500 BNB. In the rules however, Binance states that the creation of fake accounts is tantamount to distributing BNB en masse and resulting in automatic disqualification from the competition.

Jeff Huang maintains his stance that Mithril did not cheat during the community coin listing since they were later listed on Binance.

Mithril used the same address for the Formosa ICO which was closely linked to Formosa Binance withdrawals at the time, holding $8.6m worth worth of MITH. The chart below shows the wallet that transferred BNB in bulk received ETH for gas from the largest Mithril whale wallet at the time.

Even more damning, the sizable amount of BNB that was used to cheat the Community Coin vote coincides within the day that Bun Hsu received 1980 ETH. In fact it was deposited to his Binance account just less than an hour prior to the vote.

In checking transactions on the chain, I found additional instances of BNB distributed in smaller amounts (500 BNB or less) to Binance accounts that coincide with the timeline in which FMF funds were stolen.

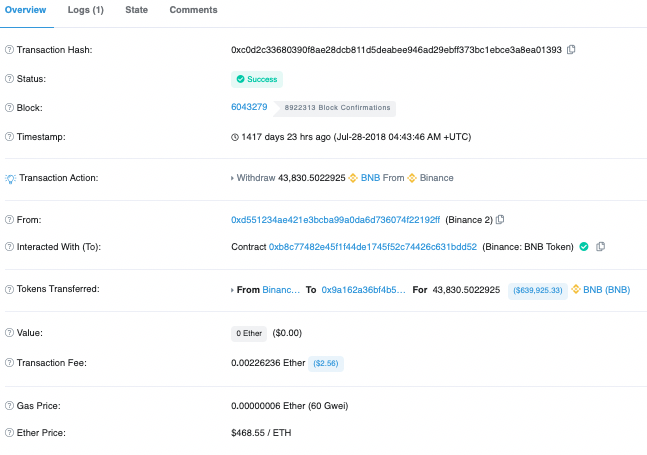

1a. 2000 ETH deposit to Bun Hsu Binance on July 28th at 3:25 am UTC

1b. 43.8k BNB withdrawal from Binance on July 28th at 4:43 am UTC (presumably Bun)

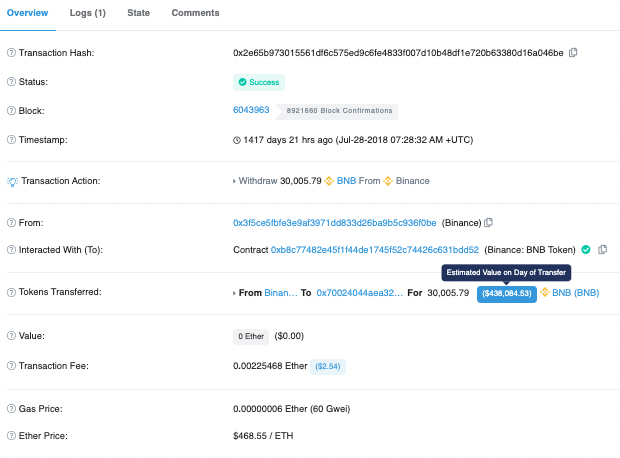

2a. 1994 ETH deposit to Harrison Huang Binance on July 28th at 7:08 am UTC

2b. 30k BNB withdrawal from Binance on July 28th at 7:28 am UTC

Once again, these addresses tie back to Mithril. It’s sad to see that this is where a portion of the Formosa Financial funds likely went.

Mithril “wins” the vote

POLY wins after Binance filter for “oddities”

Once again, this is what Formosa’s raised funds were intended for.

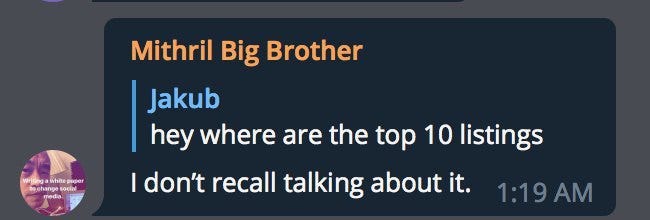

In the fall of 2018, token holders began to suspect something was off when communication with Huang, Czhang, and other key FMF team members grew increasingly distant, and no proper explanations or project updates were given. FMF continued to plummet and the sudden abandonment by key team members left the project in shambles.

Wash trading bots on IDCM

Project 3: Machi X

In October 2018, Jeff Huang and Leo Cheng launched Machi X, a social marketplace for intellectual property rights, however they struggled to receive funding due to the performance of Huang’s previous project Mithril and the Formosa incident.

Jeff Huang: “Machi X was funded by Mithril holders who got an airdrop. It was a pioneer in the space of selling music copyrights on-chain, but once it was clear there was no product market fit it was wound down”

Mithril was listed on Binance in November 2018, which coincided with team allocation unlocks. By then, MITH was down over 80%.

It wasn’t until over a year after launch that Formosa investors would finally be clued in to what allegedly happened with their funds. On August 12th 2019, Formosa investors received an anonymous email sharing 22,000 / 44,000 ETH had been moved from the Formosa Financial private sale wallet just three weeks after the 2018 ICO. Various internal documents attesting to this were attached to the email.

In this leaked audio from 2019, former CEO of Formosa Ryan Terribilini shares his side of the story of what happened even though Ryan held full control of the multisig and funds.

I reached out to multiple VC’s and angels who invested in the project to better understand why they didn’t pursue legal action. It mainly came down to the fact that Jeff and George were seen as powerful figures in Taiwan and the investors I spoke to were afraid of what might happen if they came forward. Others simply didn’t want to deal with the mess since what happened had taken place across multiple jurisdictions. All were in agreement that they just wanted to forget that this ever even happened in the first place.

Project 4: Cream Finance

In 2020 the crypto market began to heat up again. Jeff forked Compound Finance, a decentralized peer to peer lending platform, to create Cream Finance with Leo Cheng in early July of 2020. Bun Hsu, Jeremy Yang, and Stanley Yang were among Cream’s dev team advised by Compound. As of today, Cream Finance has been exploited multiple times for more than $192m. $100M+ has has been returned to those affected by the exploits to date.

Jeff Huang: Cream was left in the hands of a highly-respected team in 2020, prior to the two exploits on Aug and Oct 2021. I returned to steward the protocol in Feb 2022 and recovered funds for those impacted by the exploits.

Project 5: Wifey Finance

In August, Wifey Finance, a Yearn Finance fork, was created by an ‘anon team’, Machi, Leo Cheng, and Wilson Huang all happened to be among the first members of the Wifey Discord channel. Transaction records show that Wifey’s deployer sent funds to Wilson Huang multiple times. After four days, Wifey Finance was abandoned.

Jeff Huang says he had no involvement beyond chasing projects early.

Project 6: Swag Finance

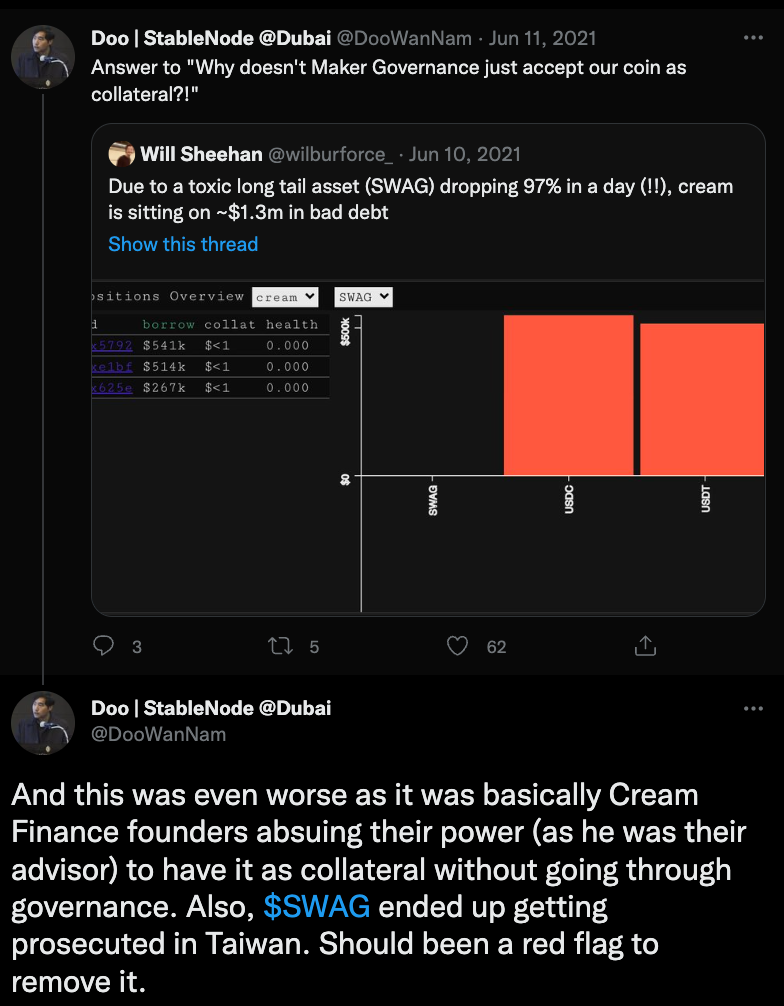

Another project tied to Machi, Swag.live was an adult entertainment site that launched its governance token in early October of 2020. When Swag was quietly listed as collateral on Cream Finance, the lack of transparency surrounding the listing caused a fair amount of controversy on Crypto Twitter. Within a few weeks, the token was farmed, dumped, and delisted from Cream from lack of on-chain liquidity.

Swag delisted from Cream 1.5 months post token launch

Project 7: Mith Cash

On December 30th of 2020, Mithril was back with a new project: Mith Cash, a fork of Basis Cash protocol (an algorithmic stablecoin). Just days after launching, Mith Cash grew to $1b TVL before crashing violently as token holders cashed out their rewards. Mith Cash eventually suffered the same fate as Basis Cash. Similarly to other projects, the team was ‘anon’ and Jeff as an early buyer.

Jeff Huang says he lost money from Mith Cash

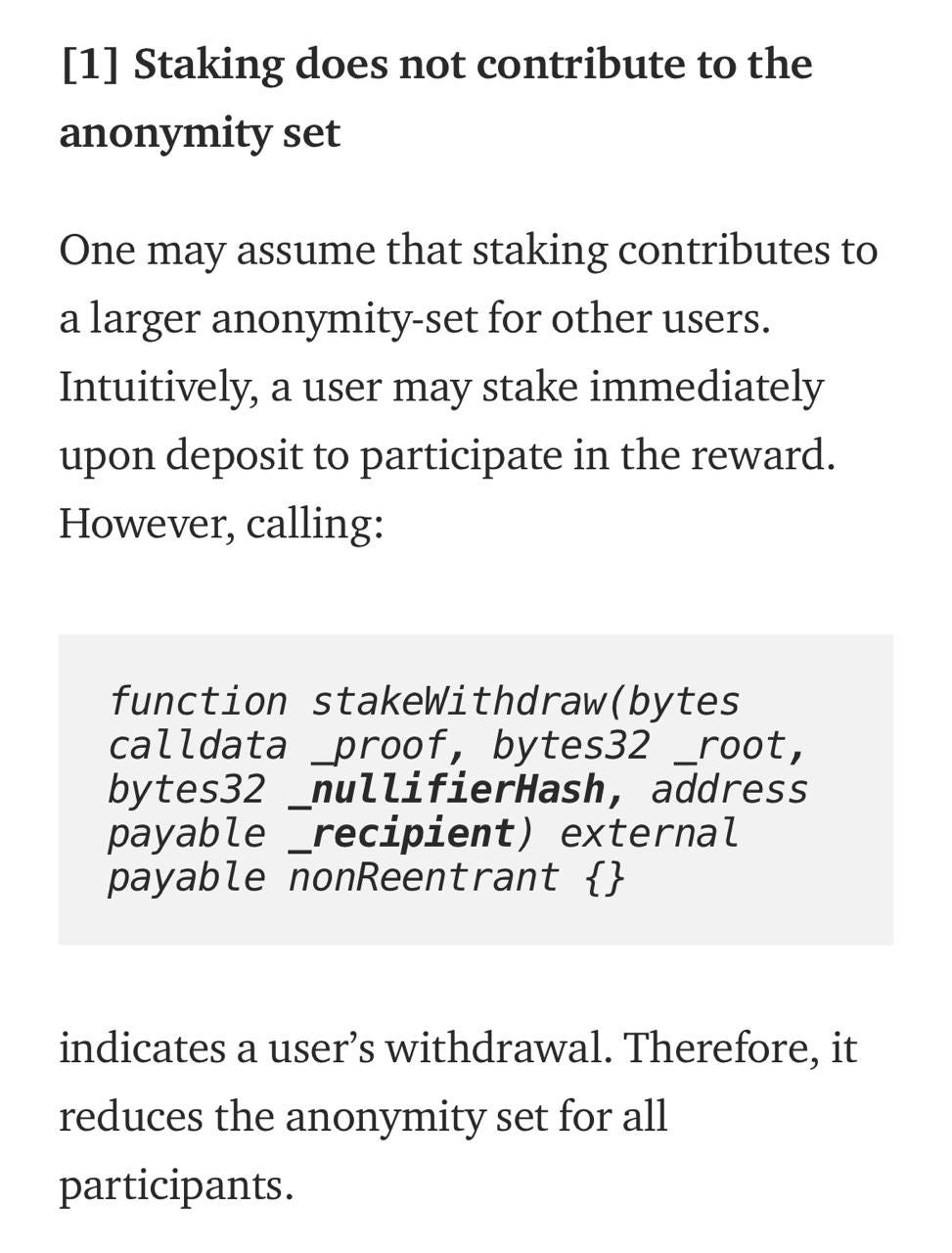

Project 8: Typhoon Cash

Shortly after the crash and burn of Mith Cash, Jeff was back to buying projects with an anon team early again with Typhoon Cash, a Tornado Cash fork. At launch it had been quite clear that the development was sloppy at best. Anyone was able to stake in the anonymity pool and remain anonymous, however, staking in the pool was necessary in order to receive rewards. This meant that in order to receive rewards, your rewards deposit would be doxxed, rendering the concept of an anonymous coin worthless. Within weeks after farming began, the project was abandoned, leaving members of the Telegram and Discord channels screwed over.

Jeff Huang says he lost money from Typhoon Cash

Rewkang one of first five members in the Telegram

**Typhoon Cash vulnerability revealed by Avner and **verified by Nick

Example:

withdraw address is under “recipient”

unstake and withdraw from second address

No updates have been posted in the Discord, Telegram, or Twitter since February 2021 , leaving people screwed over.

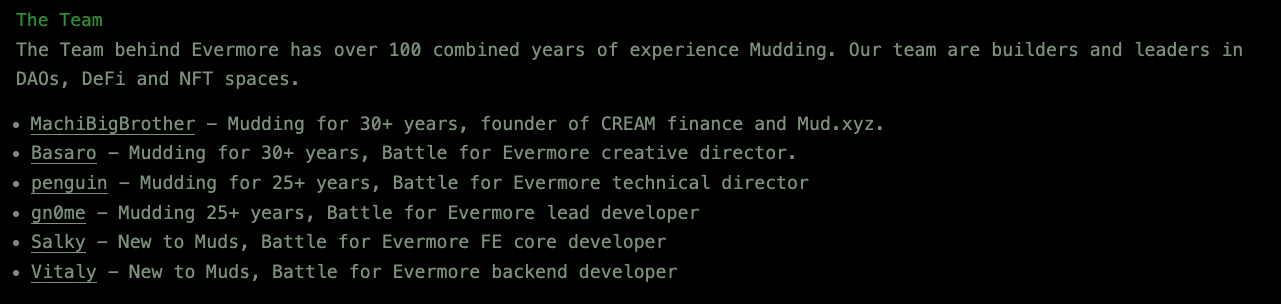

Project 9: Mud Games

With the sudden rise in popularity of Loot for Adventurers (randomized in-game assets stored on-chain) at the end of August 2021, Jeff was soon involved with his own version called Heroes of Evermore, which quickly raised 533.92 ETH for the anon team. Unlike Loot, for Heroes of Evermore there were suspicions it was not randomized as insiders minted some of the rarest NFTs from the collection, unbeknownst to Evermore holders.

Jeff Huang says that he has not sold his NFTs and says that it was indeed randomized contrary to how it looked.

Both team members Jeff & penguin minted #2 and #3 for rarity of the collection

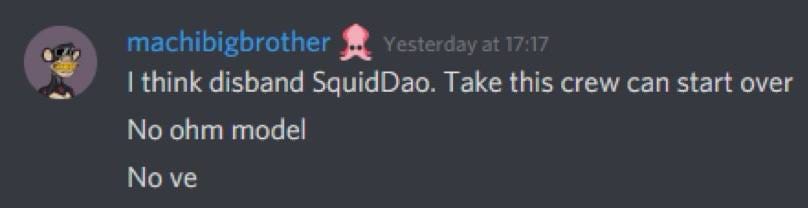

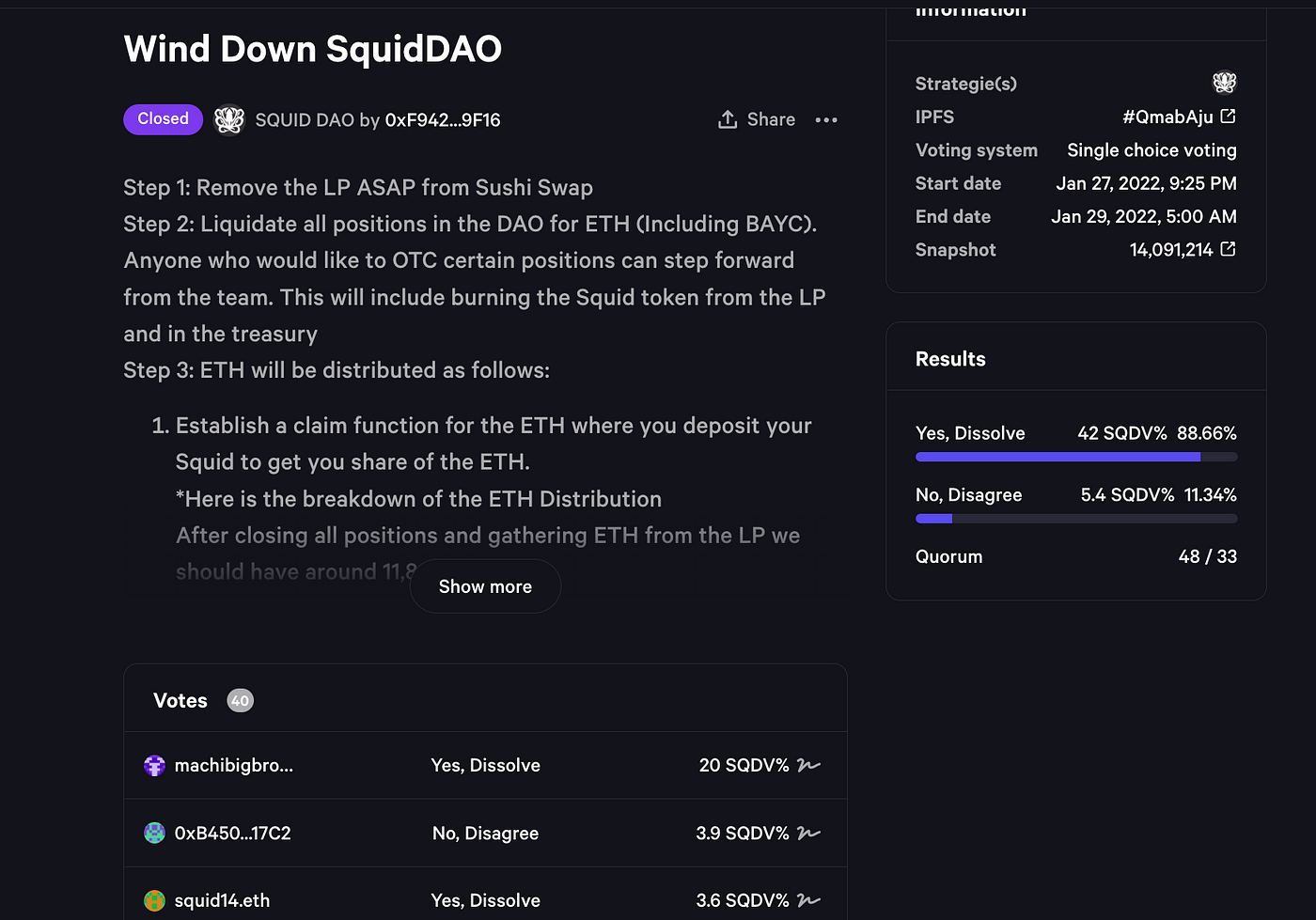

Project 10: Squid DAO

Once again, an ‘anon team’ was behind the launch of Squid DAO, an OHM/Nouns DAO fork that appeared in October of 2021. Among the early holders was MachiBigBrother.eth. By January 2022 the project was shut down at the suggestion of Machi with 60% of the funds returned back to investors.

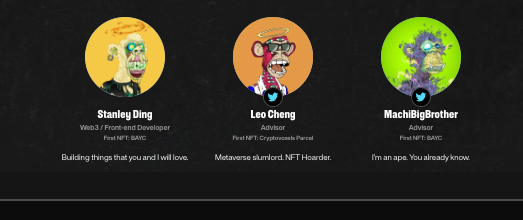

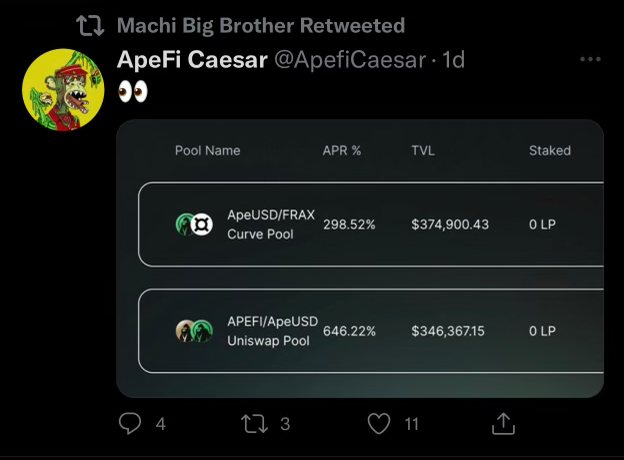

Nowadays Machi has moved onto X, XY Finance, and most recently, his newest fork: Ape Finance.

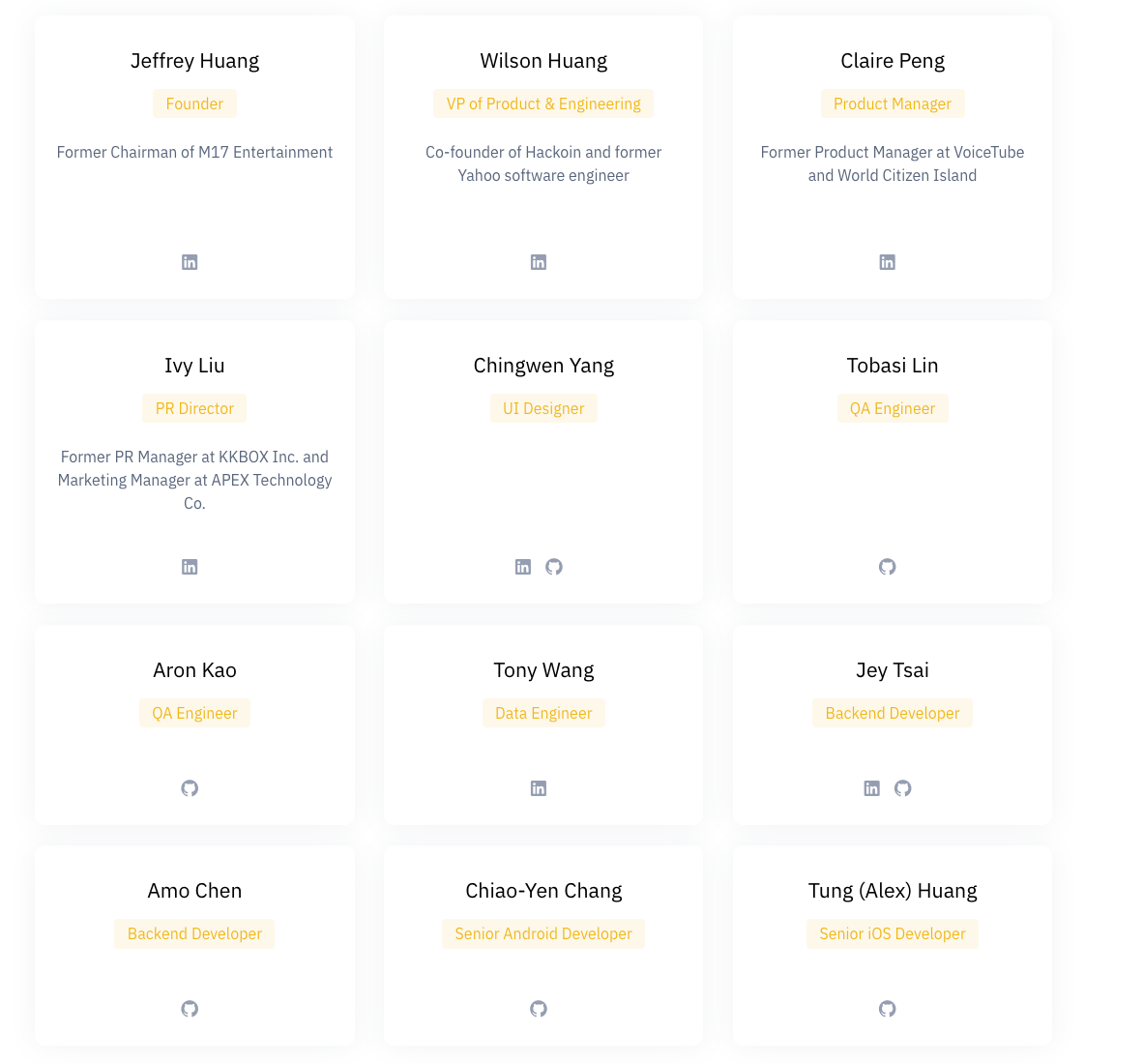

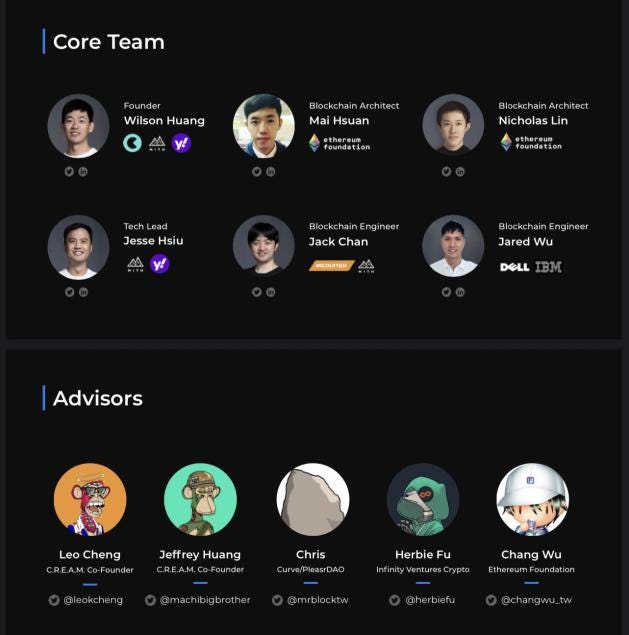

XY Finance Team & Advisors

X Advisors

In so many of projects linked to Jeff we see the same reoccurring themes play out: anon teams, forked projects, fresh wallets funded via FTX, and short lifecycles. We see the same players in every project, Wilson and/or Leo are always in the mix. VC’s like Andrew Kang even turn a blind eye. I reached out to Andrew in October 2021 and this is what he had to say:

Then in February, Andrew threw his support to Jeff again, even though at this point, Cream did not have much activity. It’s sad to see people turn a blind eye to obvious rugs when money is involved, especially when the parties involved have financially harmed others at significant cost.

I reached out to Jeff prior to the release of this article as a general courtesy. He reinforces he was just compensated for his advisor role at Formosa, claims he did not know of the 4980 ETH payment to Bun or Harrison, and he maintains that Mithril never cheated in the Community Coin competition. I believe that there are simply too many coincidences between all of these projects for this to be the case.

If you would like to support my research I accept tips:

zachxbt.eth

0x9D727911B54C455B0071A7B682FcF4Bc444B5596